What Kind of Loan Do You Need?

Broadly, there are three loan categories that you could borrow into. These loans are specific to what your business currently needs. You can also choose on the basis of the stage of business that you’re in.

Working Capital Loan:

Working capital is the money you need to meet your day-to-day business expenses like your monthly electricity bills. All your operational costs come under working capital and some loans are crafted to suit your working capital needs alone. The loans are offered typically for a 12-month tenure and have an interest rate of 12% to 16%. These can be either secured or unsecured.

Corporate Term Loan:

Term loans are used to start a venture or expand a business. Therefore, if you are starting up, you may want to look at term loans/funding. These are large sums of money borrowed from banks or financial institutions that are expected to be repaid over a longer period of time. These loans are secured (company assets) and have a longer tenure and the interest rate is negotiable. They can be converted into equity options and also have tax benefits.

Term Loan:

These loans are used to buy fixed assets. If you want to put up an office, you could consider borrowing a term loan. Typically, these loans are secured with a tenure of 1-10 years and a floating interest rate between 10 and 20%.

3 govt. small business loans you should know about:

The government of India has partnered with financial bodies to make credit availability easy for SMEs in the country. If you are planning on starting something of your own and are in need of money, you can consider one of these small business loans schemes offered by the government of India.

1. The Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS)

This scheme is run by the government of India in collaboration with SIDBI (Small Industries Development Bank of India) to give unsecured loans to businesses. You can borrow up to Rs.100 Lakh in term loans or working capital loans as per your eligibility and feasibility.

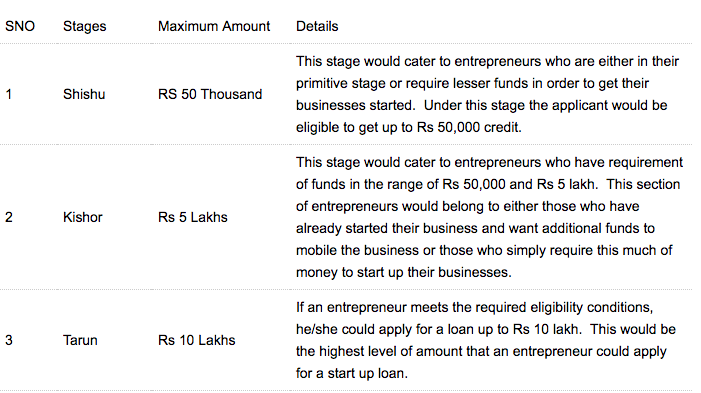

2. The MUDRA Loan Scheme

MUDRA stands for Micro Units Development and Refinance Agency Ltd. It is an agency launched by the government of India to facilitate corporate term loans to entrepreneurs. Take a look at its featuresin this table below:

3. Stand Up India Scheme

The Stand Up India scheme is a special scheme started by the government of India to financially empower SC/ST and women entrepreneurs. You can borrow between Rs. 10 lakh and Rs. 1 CR to start a manufacturing, trading or service unit, which is to be repaid in 7 years.