Aadhaar, the 12-digit unique identification number has created a lot of news in the recent time. However, the deadlines to link Aadhaar card with a hostile number of services is nearing. In spite of this, most people are not aware of this urgency and are just following the crowd.

So, why is the government trying to link everything to Aadhaar?

The answer is simple. The government wants to keep a track of all the transactions in a single click by just entering the Aadhaar number. Here are a few reasons why the government is urging everyone to get an Aadhaar card and link it with a bunch of services.

Why should you link Aadhaar card to your bank account?

The government is asking individuals to link Aadhaar card with your bank account to avoid fraudulent practices. By linking Aadhaar card, the government will be able to provide additional security to the bank accounts.

You must be wondering how? Linking Aadhaar card will weed out the bank accounts run by fraudsters, criminals, money launders and more. Moreover, it will keep the account more secure. For example, let’s assume you have linked your bank account to the Aadhaar number. If a fraudster tries to withdraw money, it will now be easy to locate and punish a fraudster.

The last date to link your bank account with Aadhaar is 31st March 2018.

Why should you link Aadhaar card with PAN?

PAN is required to track the source of income of an individual. And Aadhaar is being allocated to every individual as a Unique Identification number. Therefore, it helps the tax officials to assess whether the individual is paying taxes correctly or not.

However, this is not mandatory for all. A person with income less than taxable income(₹2.5 lakhs or less) does not need to link their PAN with Aadhaar card. In spite of this, it is recommended to get it done to avoid last-minute rush if the rules change in future.

The last date to link your PAN card with Aadhaar is 31st March 2018.

Why should you link Aadhaar card with your mobile numbers?

It has been found that most of the criminals and terrorists get their SIM card issued with duplicate documents. The documents contain fictitious and sometimes, real names without them having knowledge about the same.

When every mobile number is linked with Aadhaar card, then criminals using mobile phones can be easily identified. Therefore for your own security and nation’s, it is necessary to link Aadhaar card with your mobile number(s).

The last date to link your mobile numbers with Aadhaar is 31st March 2018.

Why should you link Aadhaar card with your driving license?

The government is focussing on linking Aadhaar to your driving license in order to curb the issue of fake and duplicate license. This will help the government confirm the physical identity with the help of digital technology. Moreover, it will keep a check on the registration of stolen vehicles. The biometric details of Aadhaar will be helpful in finding identity in such practices.

The last date to link your driving license with Aadhaar is 31st March 2018.

Why should you link Aadhaar card to your Demat account?

After the Union budget of 2017-18, Securities and Exchange Board of India (SEBI) has made it compulsory to link Aadhaar to your Demat account to curb money laundering and tax evasion through trading.

The last date to link your Demat account with Aadhaar is 31st March 2018.

All the chaos of Aadhaar linking is been happening with a promise of smooth governance. Let’s hope for the same!

What Is mAadhaar App And Why You Should Use It?

With Aadhaar gaining so much importance in our day to day lives, it is necessary to carry the unique identity card wherever you go. This is because you never know when Aadhaar card could be asked. Which is why the Unique Identification Authority of India (UIDAI), has launched Aadhaar-mobile app, popularly known as mAadhaar, for all the Android users.

The mAadhaar app lets you access all the Aadhaar information on your smartphone. This means the customers no longer need to carry their Aadhaar card physically.

Benefits of mAadhaar App

- One of the biggest advantages associated with mAadhaar app is that you don’t need to physically carry your Aadhaar card everywhere. Once you download the app, all Aadhaar details will be reflected in your app.

- The app lets you share your data with third-party applications with the help of QR codes, barcodes,or NFC. It can even email you the details, if necessary.

- Another benefit of mAadhaar app is that the app sends you a time-based one-time password (TOTP) instead of one-time password(OTP).

- This is one of the unique features of mAadhaar app. With the app, you can lock and unlock your biometric data. Once you lock your biometric data, you will need to unlock the data in order to access the details.

Link Aadhaar to PAN via SMS

The first and the obvious way to do this, of course, is an SMS.

You can send an SMS to 567678 or 56161 in the following format:

UIDPAN<12 digit Aadhaar><10 digit PAN>

Here’s an example: UIDPAN 123456789123 CHYPED78NS

However, remember that this will only work if you have already linked your Aadhaar to your mobile number.

How To Link Aadhaar To PAN Card?

The deadline to link Aadhaar to PAN card, which was initially 31 December 2017, had been further extended to 31 March 2018 to facilitate the process. However, if you haven’t done it yet, we are here to help you out.

The deadline to link Aadhaar to PAN card, which was initially 31 December 2017, had been further extended to 31 March 2018 to facilitate the process. However, if you haven’t done it yet, we are here to help you out.You can easily link your Aadhaar to your PAN card, in a few simple ways.

Link Aadhaar to PAN via SMS

The first and the obvious way to do this, of course, is an SMS.

You can send an SMS to 567678 or 56161 in the following format:

UIDPAN<12 digit Aadhaar><10 digit PAN>

Here’s an example: UIDPAN 123456789123 CHYPED78NS

However, remember that this will only work if you have already linked your Aadhaar to your mobile number.

Link Aadhaar to PAN Online

You can link Aadhaar to PAN online through the Income Tax E-Filing website.

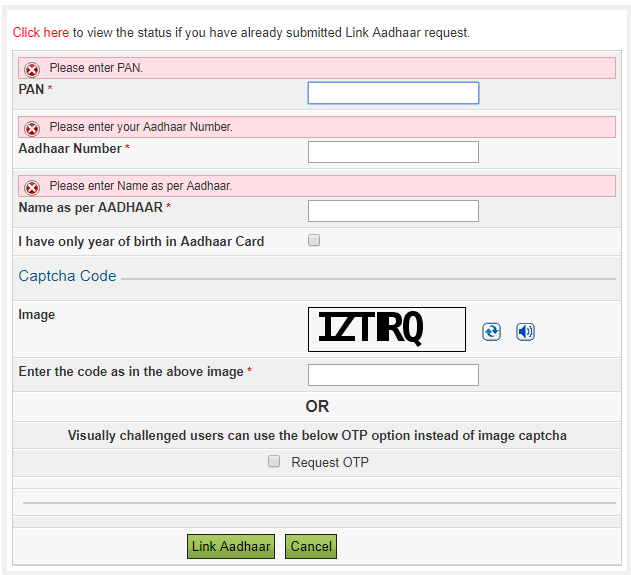

Non-Registered Users can complete this in the following 2 steps:

1: Visit the income tax e filing portal https://incometaxindiaefiling.gov.in/ and click on the Link Aadhaar option on the left pane.

2: Fill information on the following page, and click Link Aadhaar.

And you’re done!

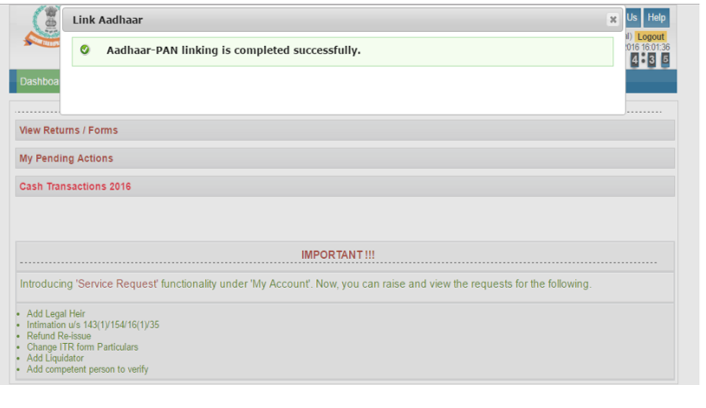

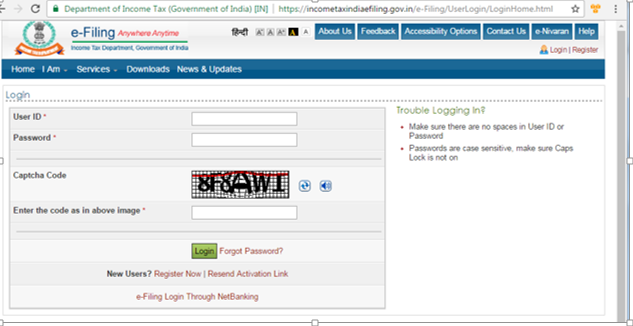

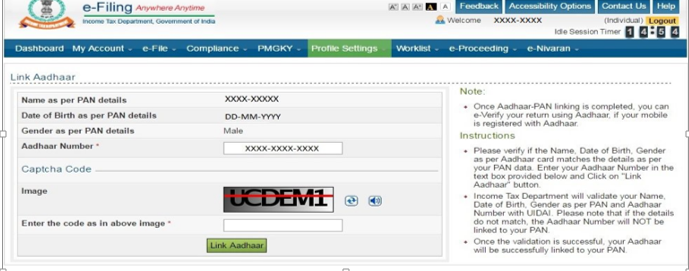

Registered users can link Aadhaar with the following 5 steps:

1: Go to the income tax e filing portal https://incometaxindiaefiling.gov.in/.

2: Log-in using your username and password.

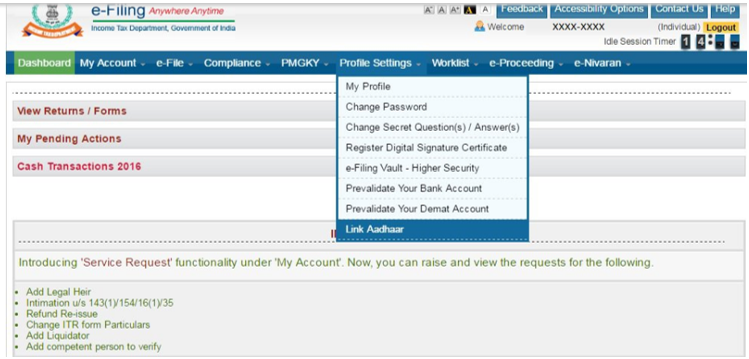

3: Go to Profile Settings and click on Link Aadhaar.

4: Your basic details will already be filled as per the details submitted at the time of registration on the e-Filing portal. You now need to verify these details with those mentioned on the Aadhaar card and ensure that everything is correct.

5: Enter your Aadhaar card number and the captcha code, and click on Link Now.

And voila, you’re done!